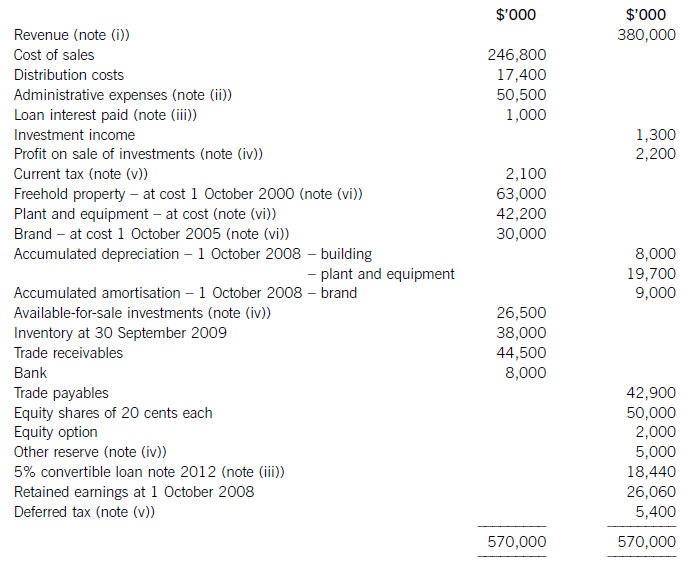

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

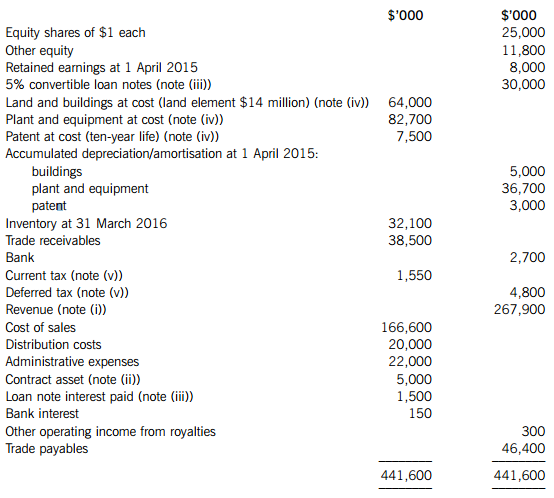

The following trial balance relates to Downing Co as at 31 March 2016:The following notes

The following trial balance relates to Downing Co as at 31 March 2016:

The following notes are relevant:

(i) Revenue includes an amount of $16 million for a sale made on 1 April 2015. The sale relates to a single product and includes ongoing servicing from Downing Co for four years. The normal selling price of the product and the servicing would be $18 million and $500,000 per annum ($2 million in total) respectively.

(ii) The contract asset is comprised of contract costs incurred at 31 March 2016 of $15 million less a payment of $10 million from the customer. The agreed transaction price for the total contract is $30 million and the total expected costs are $24 million. Downing Co uses an input method based on costs incurred to date relative to the total expected costs to determine the progress towards completion of its contracts.

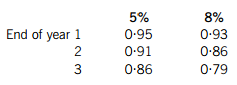

(iii) Downing Co issued 300,000 $100 5% convertible loan notes on 1 April 2015. The loan notes can be converted to equity shares on the basis of 25 shares for each $100 loan note on 31 March 2018 or redeemed at par for cash on the same date. An equivalent loan note without the conversion rights would have required an interest rate of 8%.

The present value of $1 receivable at the end of each year, based on discount rates of 5% and 8%, are:

(iv) Non-current assets:

Due to rising property prices, Downing Co decided to revalue its land and buildings on 1 April 2015 to their market value. The values were confirmed at that date as land $16 million and buildings $52·2 million with the buildings having an estimated remaining life of 18 years at the date of revaluation. Downing Co intends to make a transfer from the revaluation surplus to retained earnings in respect of the annual realisation of the revaluation surplus. Ignore deferred tax on the revaluation.

Plant and equipment is depreciated at 15% per annum using the reducing balance method.

During the current year, the income from royalties relating to the patent had declined considerably and the directors are concerned that the value of the patent may be impaired. A study at the year end concluded that the present value of the future estimated net cash flows from the patent at 31 March 2016 is $3·25 million; however, Downing Co also has a confirmed offer of $3·4 million to sell the patent immediately at that date.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 31 March 2016. All depreciation/amortisation is charged to cost of sales.

There were no acquisitions or disposals of non-current assets during the year.

(v) The directors estimate a provision for income tax for the year ended 31 March 2016 of $11·4 million is required. The balance on current tax in the trial balance represents the under/over provision of the tax liability for the year ended 31 March 2015. At 31 March 2016, Downing Co had taxable temporary differences of $18·5 million requiring a provision for deferred tax. Any deferred tax movement should be reported in profit or loss. The income tax rate applicable to Downing Co is 20%.

Required:

(a) Prepare the statement of profit or loss and other comprehensive income for Downing Co for the year ended 31 March 2016.

(b) Prepare the statement of changes in equity for Downing Co for the year ended 31 March 2016.

(c) Prepare the statement of financial position of Downing Co as at 31 March 2016.

Notes to the financial statements are not required. Work to the nearest $1,000.

The following mark allocation is provided as guidance for these requirements:

(a) 11 marks

(b) 4 marks

(c) 10 marks

(d) The finance director of Downing Co has correctly calculated the company’s basic and diluted earnings per share (EPS) to be disclosed in the financial statements for the year ended 31 March 2016 at 148·2 cents and 119·4 cents respectively.

On seeing these figures, the chief executive officer (CEO) is concerned that the market will react badly knowing that the company’s EPS in the near future will be only 119·4 cents, a fall of over 19% on the current year’s basic EPS.

Required:

Explain why and what aspect of Downing Co’s capital structure is causing the basic EPS to be diluted and comment on the validity of the CEO’s concerns. (5 marks)

答案

答案